Seniors who utilise fixed deposits as a means of conserving money and as a vehicle to build emergency savings are fond of them. Fixed deposits guarantee consistent interest income and provide liquidity. Fixed deposit interest is taxed, but many elderly people are in lower tax bands, so if they have little in the way of additional income, their tax burden will be minor or nonexistent.

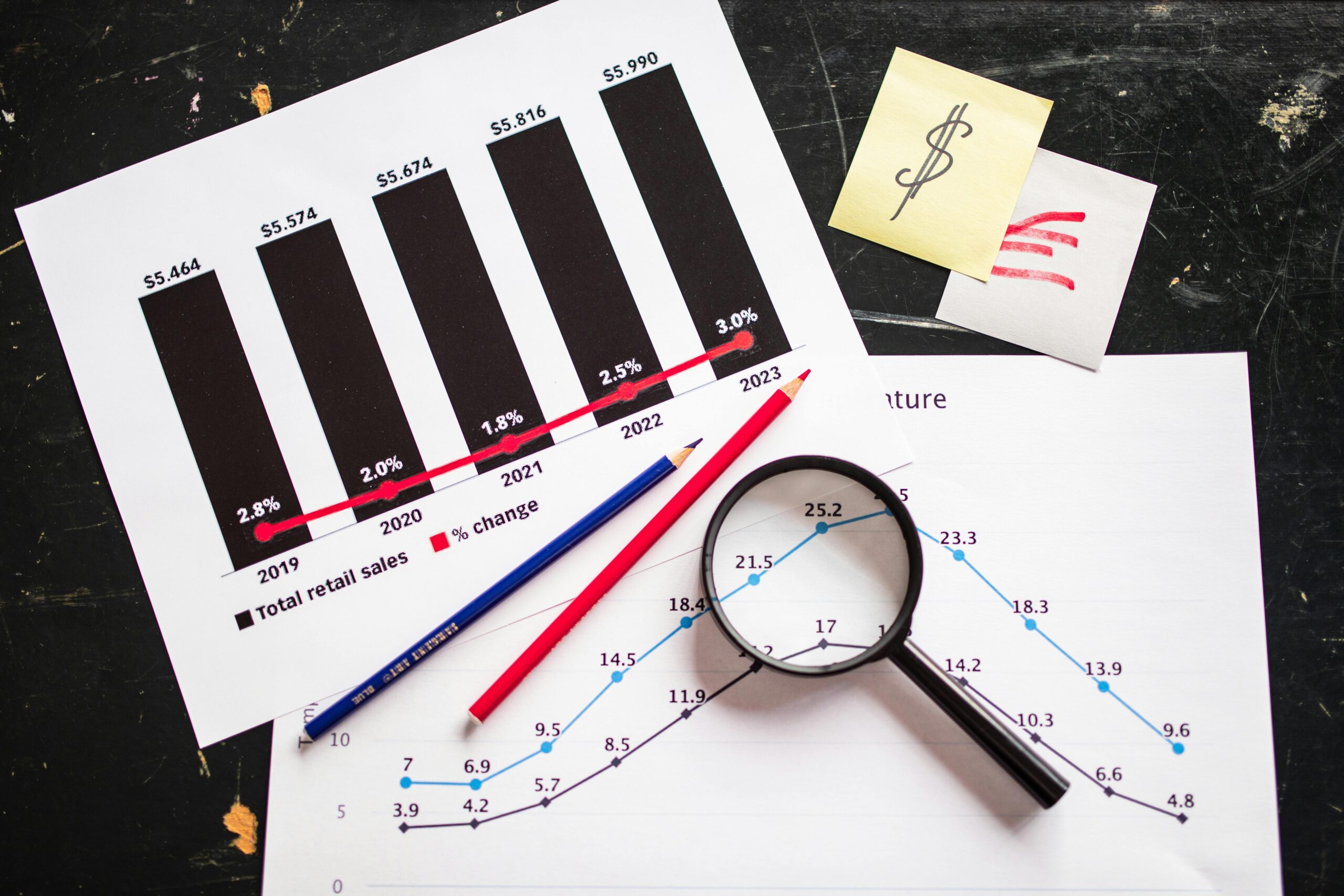

Seniors can currently get interest rates on three-year fixed-rate deposits (FDs) of up to 7.75 percent from both public and private sector banks. The top 10 banks (based on term deposit holdings) are shown below, offering attractive interest rates on three-year fixed-rate deposits. The data has been compiled by Bankbazaar.

The holdings of term deposits, the best interest rate available to Indian residents over 60, and 3-year fixed deposits under Rs 1 crore are the primary criteria used to shortlist these institutions. Interest compounding on a quarterly basis is used to get the value. These figures refer to February 19, 2024.

BANK OF BARODA

The headquarters of the Indian multinational public sector bank Bank of Baroda are located in Vadodara, Gujarat. Having 153 million customers, a total revenue of US$218 billion, and 100 abroad locations worldwide, it is the second largest public sector bank in India, behind State Bank of India. It comes up at number 586 on Forbes Global 2000 ranking based on data from 2023.

The bank was established on July 20, 1908, in the Gujarati princely state of Baroda by Sayajirao Gaekwad III, the Maharaja of Baroda. On July 19, 1969, the Bank of Baroda was nationalized by the Indian government, along with thirteen other significant commercial banks in the country. The bank was therefore classified as a profitable public sector undertaking (PSU).It provide the interest rate on three year FDs for senior citizens for 7.75 % which means if we invested 1lakh rupees for 3 years it will grow to 1.26 lakhs.

AXIS BANK

Mumbai, Maharashtra-based Axis Bank Limited, formerly known as UTI Bank (1993–2007), is a multinational banking and financial services firm in India. In terms of assets, it is the third-biggest private sector bank in India; in terms of market capitalization, it ranks fourth. It offers financial services to retail, small and medium-sized enterprises, and SMEs.

The promoters and the promoter group (United India Insurance Company Limited, Oriental Insurance Company Limited, National Insurance Company Limited, New India Assurance Company Ltd, GIC, LIC, and UTI) owned 30.81% of the shares as of June 30, 2016. Mutual funds, FIIs, banks, insurance companies, business entities, and individual investors own the remaining 69.19% of the shares. The interest rate on 3 years FDs for senior citizens for 7.60 % which means if we invested 1 lakh rupees for 3 years it will grow to 1.25 lakhs.

HDFC BANK

Mumbai is home to the global banking and financial services firm HDFC Bank Limited, commonly referred to as HDFC. As of August 2023, after acquiring parent firm HDFC, it is the largest private sector bank in India in terms of assets and the fifth-largest bank globally in terms of market capitalization. As banks that are “too big to fail,” the Reserve Bank of India (RBI) has designated HDFC Bank, State Bank of India, and ICICI Bank as Domestic Systemically Important Banks (D-SIBs).

The bank started operations in January 1995, having been founded in August 1994 following its former parent company HDFC’s ‘in principle’ clearance by the RBI to establish a bank in the private sector as part of its liberalization of the Indian banking sector. As of January 2024, HDFC Bank has a market valuation of $140 billion, making it the third-largest firm listed on Indian stock exchanges. With about 1.73 lakh workers, it ranks as India’s sixteenth largest employer. The interest rate on three year FDs for senior citizens is 7.50% it means if we invested 1 lakh rupees for 3 years it will grow to1.25 lakh rupees.

CANARA BANK

Canara Bank is a prominent public sector bank operating in India. It was founded in 1906 in Mangalore by Ammembai Subha Rao Pai. This bank, which was nationalised in 1968, consists of 6310 branches and over 8851 ATMs located throughout 4467 locations. With offices in London, Hong Kong, Moscow, Shanghai, Dubai, Tanzania, and New York, Canara Bank is based in Bengaluru. The interest rate on three year FDs for senior citizens is 7.30% which means is we invested 1 lakh rupee for 3 years it will grow to 1.24 lakh.

SBIN

With its headquarters located in Mumbai, Maharashtra, State Bank of India (SBI) is a multinational public sector bank and financial services statutory entity in India. SBI is the only Indian bank listed on the Fortune Global 500 list of the biggest companies in the world for 2020, placing it as the 48th largest bank globally in terms of total assets. With a 23% asset market share and a 25% share of the entire loan and deposit market, this public sector bank is the biggest in India. With about 250,000 workers, it ranks as India’s tenth-largest employer. The company held seat 77 in Forbes Global 2000 in 2023. The interest rate on three year FDs for senior citizens is 7.25% which means if we invested 1 lakh rupees for 3 years it will grow to 1.24 lakh.