Today’s stock market: On Tuesday, October 22, a massive selloff swept through the Indian stock market, pushing the benchmarks, the Sensex and the Nifty 50, down more than 1% apiece.

The Nifty 50 ended the day at 24,472.10, down 309 points, or 1.25 percent, while the Sensex ended the day at 80,220.72, down 931 points, or 1.15 percent.

The market’s mid and smallcap sectors experienced even more severe losses. The BSE Smallcap index plummeted 3.81 percent, while the BSE Midcap index finished with a loss of 2.52 percent.

Investors lost over ₹9 lakh crore in a single day as the total market capitalization of the companies listed on the BSE fell to almost ₹444.7 lakh crore from nearly ₹453.7 lakh crore in the previous session.

In the Nifty 50 index, just three stocks closed higher: ICICI Bank (up 0.74 percent), Nestle (up 0.10 percent), and Infosys (up 0.04 percent).

The sectors indexes that had the worst crashes were Metal (down 3%), Realty (down 3.38%), and Nifty PSU Bank (down 4.18%).

Oil and Gas, Media, Consumer Durables, and Nifty Auto all had declines of more than 2%. While the Private Bank index lost 0.97 percent, the Nifty Bank index fell 1.36 percent.

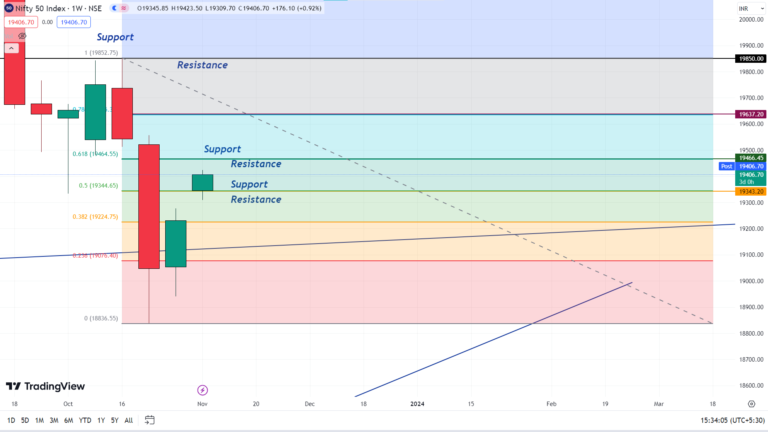

The Nifty 50 has now corrected by around 7% from its record high, according to Ajit Mishra, SVP of Research at Religare Broking. It has reached the important moving average support at the 100 DEMA (day exponential moving average), or 24,485 level.

“The forecast points to more declines, especially in the smallcap and midcap sectors. On the index front, the next significant support is at about 24,000. If there is a comeback, the next possible resistance is between 24,700 and 25,000. We advise avoiding adding to lost positions and suggest modifying transactions appropriately,” Mishra stated.

What caused today’s share market decline?

The main variables influencing market mood, according to experts, are high global tensions, the uncertainty surrounding the US election in 2024, and a prolonged selloff by foreign portfolio investors (FPIs).

Furthermore, the Indian stock market’s stretched valuation and poor September quarter profits are also fueling the market’s decline.