Version 1.0.0

The IPO of Hyundai Motors, which began subscriptions on October 15 and ended on October 17, is scheduled to launch on the Indian stock exchange on October 22.

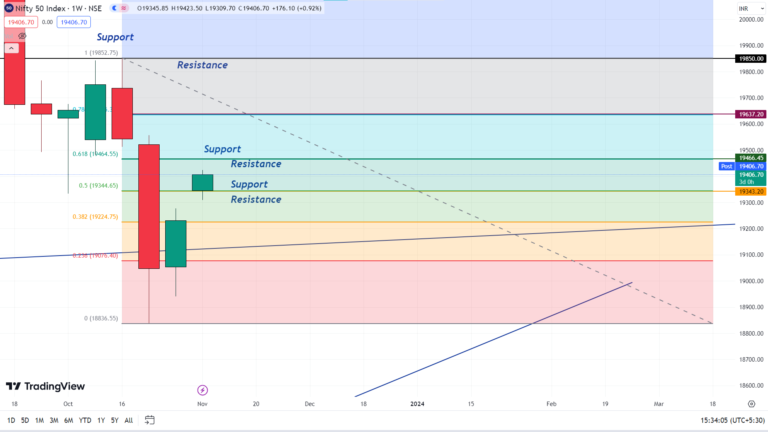

However, Hyundai Motors’ Grey Market Premium (GMP) points to a declining trend before its IPO on Tuesday, which might result in a flat debut.

Investor gain reports that Hyundai Motors is presently selling on the grey market for a premium of ₹45, only 2.3% more than the IPO price of ₹1960.

As a result, market watchers predict that Hyundai Motors’ listing price will be about ₹2,005.

On the first day of its IPO, Hyundai Motors’ GMP was +63; however, throughout the subscription period, it fell. According to statistics from Investor gain, the GMP had fallen sharply by the last day of subscriptions on October 17, reaching -32 on the grey market.

On the day of allocation, October 18, Hyundai Motors’ GMP increased to +5.

According to an investigation by specialists at investorgain.com, the lowest GMP ever recorded is Re 0, while the highest GMP ever recorded for any IPO is ₹570. Investors’ willingness to pay more than the issue price is shown by the “grey market premium.”

However, it is crucial to remember that grey market premiums are only a measure of the company’s share value in the unlisted market and are subject to rapid fluctuations.

The largest public offering in India to date, the ₹27,870 crore IPO, barely made it through the last rounds of bidding, mostly due to high demand from non-institutional investors. The offering was undersubscribed in both the retail and non-institutional investor sectors.

The initial public offering (IPO) pricing of Hyundai Motor India was set at ₹1,865 to ₹1,960 per share. There was no fresh issue component to the ₹27,870.16 crore offering; rather, it was an offer for sale (OFS) of 14.22 crore shares.

Qualified Institutional Buyers (QIBs) get half of the net public issue size (not including the share set aside for staff), with up to 60% of that amount going to anchor investors. Furthermore, 35% of the shares are designated for regular investors, while 15% are put aside for non-institutional investors. Additionally, up to 7,78,400 equity shares have been set aside by the corporation especially for its staff.