KPIT Technologies Limited, a global firm based in India, offers engineering research and development (ER&D) services to the automobile industry. This business is often known as KPIT and is headquartered in Pune. KPIT has development facilities in India as well as in Europe, United States, Japan, and China.

KPIT has published some academic articles and filed 58 patents. Apart from this, it has won many honours for its innovative work.

Ravi Pandit and Kishor Patil co-founded KPIT in 1990 under the name KPIT Info systems. They were partners in the accounting business Kirtane & Pandit Chartered Accountants (KPCA), and they are both chartered accountants by profession. The business was 50 times oversubscribed when it launched its first public offering (IPO) in 1999.

The firm was renamed KPIT Cummins Info systems Ltd. after Cummins Infotech, the IT division of Cummins, amalgamated with KPIT in 2002.

The company was renamed “KPIT Technologies Limited” from KPIT Cummins Info systems in September 2013. This was consistent with Cummins’ choice to decrease its ownership of KPIT in order to concentrate on its primary business of producing engines and generators.

FUNDAMENTALS OF KPIT TECHNOLOGIES

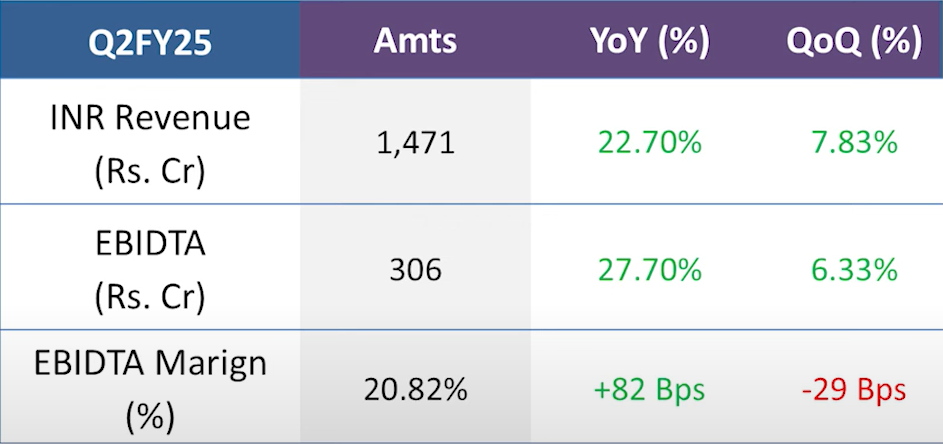

KPIT Technologies announce it’s result yesterday and after the announcement the stock fall by 15%.The company revenue growth on Q2 FY2025 on year on year basis has increase by 22.70% and the QoQ growth of the company is 7.83%.

In terms of EBIDTA show growth on Year on Year by 27.70% and on QoQ basis it is 6.33% and EBIDTA margin was on 20.82% and these margin increase on year on year basis by 82BPS But on QoQ basis there is a decline of 29 bps

- Revenue growth for KPIT was led by asian demand and powertrain.

- In CC terms revenue growth for Q2 FY2025 : 20.30% on YoY basis, 4.70% ON QoQ basis.

- FY25 guidance : Revenue growth:18-22% CC term ( 18% manageable as OEMS focus on cost reduction) EBIDTA margin- 20.5% (higher than this is achievable)

GEOGRAPHY WISE

The revenue of US is 47.59 which was increase by 7.80% ON YoY basis and on QoQ basis it increase by 2.40%.The revenue of Europe is 84.46 which was increase by 10.60 on YoY basis and on QoQ basis it show decline of 0.60%.The revenue of asia is 41.13 which have a growth of 66.60% on YoY basis and 23.10% on QoQ basis.

TECHNICAL ANALYSIS OF KPITTECHNOLOGIES

The stock show a bull rally from past 1 year and give returns of around 315% but during it’s bull rally stock is taking support from a trendline from December 2022 to till present and currently also price is trade4d near to it’s weekly support trendline.

If we apply the Fibonacci retracement indicator we can see that price is near to the level of 0.382 which was considered a strong level of Fibonacci retracement.